What inspired the choice of “Future Proofing Nigeria’s Financial System: Policy, Technology, and Market Confidence” as the theme for the 9th Financial Markets Conference of the Financial Markets Dealers Association (FMDA)?

We chose this theme to emphasise how important it is to align policy, technology, and market confidence in order to secure the long-term stability and resilience of Nigeria’s financial system. The financial landscape is changing rapidly, especially with the ongoing recapitalisation of Deposit Money Banks (DMBs). It is therefore essential that we future proof the system so that it can absorb shocks and take advantage of emerging opportunities. This conference will provide a platform for stakeholders to discuss, align, and contribute to the next phase of development in Nigeria’s financial sector.

How do you envision policy, technology, and market confidence intersecting to future proof Nigeria’s financial system?

Policy, technology, and market confidence reinforce one another. Sound policies, including the recapitalisation of banks and the Central Bank of Nigeria’s introduction of the B Match system and FX code to support the unified exchange rate, have improved transparency and strengthened investor trust. Technology then amplifies the impact of these policies by improving efficiency, deepening financial inclusion, and enhancing risk management through innovations such as instant payments, digital banking, and data analytics. When these elements move in lockstep, they create a more resilient and trusted financial system.

In what ways can technology be leveraged to drive innovation, efficiency, and transparency in Nigeria’s financial markets?

Technology is transforming Nigeria’s financial markets by making them more efficient, more inclusive, and more transparent. Payment systems have advanced through real time transfers on the NIBSS Instant Payment platform and through the growing role of Payment Service Banks and fintech firms that are extending access to underserved communities.

Automation in trading and settlement, including the adoption of the Bloomberg trading platform and digital reporting frameworks, has improved efficiency and reduced operational risk. The CBN’s open banking regulation, which requires banks to share customer data securely with other licensed institutions, will deepen transparency, competition, and product innovation. As these initiatives mature under consistent regulatory oversight, they will reduce transaction costs, improve liquidity, and strengthen confidence in Nigeria’s financial system.

How can market participants and regulators work together to build and maintain market confidence in the face of evolving economic challenges?

Market confidence is built when participants and regulators work as partners. This means collaborating on risk management to identify and address vulnerabilities early, improving transparency and disclosure to build trust, and supporting innovation through clear, predictable rules. It also includes promoting financial literacy so that consumers and investors understand the products they use, and maintaining open dialogue between regulators, market operators, and investors. When all parties engage honestly and consistently, confidence becomes more durable, even in the face of economic headwinds.

What role do you see fintech playing in shaping the future of Nigeria’s financial system, and how can its potential be maximised?

Fintech is already reshaping Nigeria’s financial system by expanding access, reducing friction, and offering new products that meet the needs of younger and underserved customers. Through mobile banking, digital wallets, Payment Service Banks, real time payments, and API driven solutions, fintechs are improving transaction speed, convenience, and transparency.

To maximise this potential, the regulatory environment must continue to encourage innovation while safeguarding consumers. This includes broadening licensing opportunities for fintechs, fostering collaboration between banks, regulators, and fintech firms, and investing in digital infrastructure, particularly broadband and payments rails. With the right balance, fintechs will complement traditional institutions and strengthen the overall competitiveness of the market.

What are the most significant risks facing Nigeria’s financial system, and how can they be mitigated through collaborative efforts among stakeholders?

Key risks include cybersecurity threats, fraud, operational weaknesses, and financial exclusion. The CBN and banks are addressing these through a mix of policy and innovation. For instance, the recent directive requiring PoS agents to operate within ten metres of their registered locations helps reduce fraud and improve accountability. Some banks have introduced panic passwords on mobile apps, which limit the visible balance to a small portion of funds under coercion, thereby reducing exposure to theft.

In addition, coordinated action by government, the CBN, banks, and fintechs is vital to manage market volatility and cyber risks. Clear regulations, modern technology, robust internal controls, and shared intelligence all work together to make the system safer, protect customers, and strengthen confidence in the market.

What are the expected outcomes of the 9th Financial Markets Conference, and how will they contribute to the development of Nigeria’s financial sector?

We expect the conference to deepen knowledge sharing among market participants, regulators, and policymakers, and to encourage stronger collaboration across the ecosystem. It should help shape more responsive policy frameworks that support both innovation and stability, and it should contribute to higher levels of market confidence through clearer communication, transparency, and trust building initiatives. Ultimately, the goal is for the insights and recommendations from the conference to feed directly into practical reforms and market development.

What message would you like to convey to investors, financial institutions, and other stakeholders ahead of the conference?

Nigeria’s financial system is undergoing important reforms that are restoring stability and rebuilding confidence. My message to investors, financial institutions, innovators, and policymakers is simple. This is the time to engage. I invite them to join us at the 9th Financial Markets Conference as we define the next phase of growth. It is an opportunity to align on policy direction, explore new technologies, and deepen collaboration in order to build a stronger, more resilient financial market for the future.

What steps are you taking to make training and financial markets knowledge readily available to financial markets participants, as well as promote digitisation of market operations?

As a Financial Markets Association, our mandate is to promote professionalism, transparency, and efficiency. We are pursuing this through capacity building, knowledge sharing, and digital transformation.

We invest continuously in training and certification programmes that upskill market participants at all levels. We organise regular workshops, masterclasses, and conferences on topics such as market risk, treasury management and operations, derivatives, compliance, and new products. We also partner with international financial markets associations and training institutions to deliver globally recognised standards and best practices. Across all programmes, we emphasise ethics, governance, and sustainability as core elements of responsible market operations.

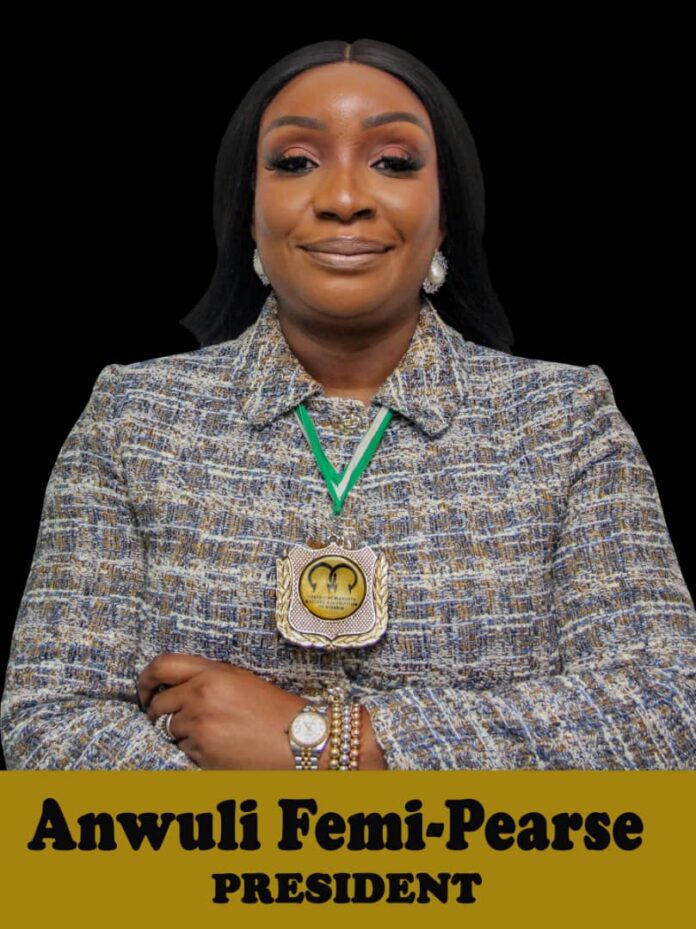

What has the experience been for you leading the FMDA in the last six months, and how far are you in implementing your vision for the Association?

The last six months have been both demanding and rewarding. Leading the Association has provided a unique opportunity to work closely with regulators, trading institutions, dealers, analysts, and infrastructure providers, all committed to the same goal of raising standards in our markets.

From the outset, I have focused on three priorities. The first is building capacity and empowering knowledge. The second is driving digital transformation and operational efficiency. The third is strengthening stakeholder collaboration and advocacy. We have made meaningful progress in each of these areas, though there is still much to do. The experience so far has confirmed that the vision is achievable when there is collective ownership and commitment.

As a highly experienced banker, what are the biggest mistakes you think are common with bank treasurers, and how should they be addressed?

Most bank treasurers in Nigeria are technically strong and highly committed, yet there are recurring gaps that can weaken performance and risk management if they are not addressed. Some of these include focusing too narrowly on daily liquidity without enough emphasis on strategic balance sheet management, underestimating the importance of data and analytics in pricing and risk, and not engaging early enough with other business units and senior management on funding and market risk issues.

The most effective treasurers are not only dealers or liquidity managers. They are strategic advisers, risk stewards, and champions of technology. To avoid common pitfalls, treasurers need to invest continuously in their own knowledge, adopt better technology and analytics, and build strong cross functional partnerships. In the current environment, the future of treasury belongs to those who combine technical excellence with strategic thinking and digital intelligence.

What are your views on the opportunities available for female bankers in today’s world, and what is your advice on work and family balance?

Opportunities for female bankers are expanding rapidly, supported by clear evidence that women are increasingly shaping leadership in Nigeria’s corporate and financial sectors. According to the 2025 PWR NGX Top 30 Gender Diversity Scorecard, women now hold 31.1 percent of all board seats in Nigeria’s most valuable companies, the highest level since tracking began. For the first time, none of the NGX top 30 companies have an all-male board, and there are now five female CEOs and three female board chairs, also the highest figures in the report’s history. More than 53 percent of these top companies have reached at least 30 percent female representation, a level that allows women to exert meaningful influence in decision making.

These trends show that the industry increasingly values diversity, innovation, leadership, and emotional intelligence, areas where women are excelling. My message to young women in finance is that you belong at the table. Your competence and perspective matter. With skills, confidence, and a supportive network, it is possible to build a fulfilling career and maintain balance at home. The aim is not perfection. It is steady progress, one intentional step at a time.

What steps are you taking to strengthen the foundations of professionalism and ethical conduct within FMDA while building momentum for long term institutional growth?

I’ll reiterate that at the heart of our vision for FMDA is the belief that sustainable market growth must rest on strong foundations of professionalism, integrity, and ethical conduct. In recent months, we have focused on strengthening both the character and technical competence of our members, while positioning the Association for long-term relevance.

We are updating and enforcing professional standards, embedding ethics and governance into our training programmes, as well as promoting behaviour that support fair and orderly markets. At the same time, we are expanding the Association’s influence by setting benchmarks that can be recognised not only in Nigeria, but across Africa and eventually at a global level. Our goal is to build an organisation that is respected for its expertise and trusted as a moral and professional compass for financial markets.